Junior Partner, Senior Partner – A Visual Journey

Excerpts from the Takshashila Institution's latest research paper, 'China-Russia Relationship: Assessing the Power Asymmetry'.

The Russian invasion of Ukraine in 2022 has brought about a major shift in the world order. Not only did it bring about a stronger trans-Atlantic alignment vis-à-vis Russia, but has also pushed the latter closer to China. Consequently, strategists around the globe have been preoccupied with the repercussions of such a partnership between the two countries. The deepening Sino-Russo relationship has become a subject of discussion in India as well.

The concern that one of India’s historically most trusted partners now possibly shares an indispensable friendship with India’s primary adversary has instigated debate around the reliability of Russia as a security partner. In this context, the most recurrent question that is being raised is: Has Russia become a junior partner of China? The answer to the question will determine the autonomy that the Kremlin can exercise when it comes to choosing between Beijing and New Delhi.

Strategic Convergences, Rising Asymmetries

The first point of convergence between China and Russia emanates from their shared antipathy for the US-dominated economic order and financial system. Both countries have been subject to a range of Western economic sanctions and export restrictions. On numerous occasions, the leaders of the two states have decried and denounced unilateral and multilateral restrictions by the West without the authorisation of the UN.

In this regard, Russia significantly depends on China to do the heavylifting to reform (redress) the current economic order and financial system. The twin threats it faces, are dollar hegemony and SWIFT dominance.

Developments since the Russia-Ukraine War began:

The US and its allies froze close to US$300 billion of Russia’s forex reserves (4 times Russia's annual defence budget).

Extremists have threatened seizing of the assets to fund Ukraine's war efforts or post-war reconstruction of Ukraine.

As of February 2024, around US$770 billion of China’s US$3 trillion forex reserves are held in US Treasuries.

In 2024, the West imposed a SWIFT ban on Russian financial institutions involved in transactions of dual-use goods or weapons. In July, the US threatened secondary sanctions on third-country financial institutions involved in such transactions with Russia.

The Chinese financial institutions have withheld transactions worth tens of billions of yuan with Russia in 2024.

Russia and China have, therefore, pushed for de-dollarisation and finding alternatives to SWIFT. While Russia’s need is urgent, this is not the case for Beijing. Nevertheless, China is committed to countering the hegemony of the dollar and SWIFT in the global financial architecture to cushion the impact of any potential American punitive measures during a contingency, such as a cross-strait conflict.

Russia’s isolation from the US-led and Western-dominated global political and economic order makes its need for solutions urgent. However, despite its grievances, China is still part of the system, which allows China to set the pace for its joint campaign against the current order.

Russia and China are separated by their differential capabilities to realise their collective goals. Beijing has more diplomatic and monetary resources than Moscow to allocate. Russia’s resources are finite and stretched, and its isolation further limits their effectiveness.

Asymmetry in Bilateral Trade

At first glance, China-Russia trade appears symmetric over the years. In fact, Russia maintains a modest trade surplus with China. But the asymmetry becomes apparent when one looks at China’s import-export basket vis-à-vis Russia, and the composition of trade between the two sides.

China, with some help from India, has absorbed most of Russia’s losses emanating from the reduced trade with EU.

China accounted for 30.4 percent of Russia’s overall exports.

Russia accounted for only ~3 percent of China’s total exports.

China accounted for 36.6 percent of Russia’s overall imports.

Russia accounted for only ~5 percent of China’s total imports.

The fact that all of China’s top five trading partners are the closest allies and partners of the US enhances the possibility of concerted economic actions against Beijing during contingencies. To an extent, this limits China’s room for coercion vis-a-vis Russia - its sole trusted trading partner. Moreover, Russia has emerged as a major destination for China’s exports at a time when its products have faced threats of sanctions in the Western market. To a certain extent, this serves China’s trade diversification strategy.

Further, it is important to look at the composition of the trade between the two countries (data sourced from Observatory of Economic Complexity):

Russia’s exports to China are dominated by oil and energy.

Crude petroleum accounted for 47 % of Russia’s exports to China in 2020.

Refined petroleum and petroleum gas together accounted for another 9%.

In 2022, more than 50 % of Russia’s exports to China were crude oil.

Refined petroleum and gas made up another 14 percent.

In contrast, China’s exports to Russia are much more diversified and not dominated by any particular commodity.

Even though machines and electronics make up for around 45% of China’s exports to Russia, the most traded commodity by value — broadcasting equipment — accounted for only a little over 9% of the total exports in 2020.

This share shrunk further to less than 6% in 2022.

China benefits from cheap Russian oil, which otherwise would be costly given the sanctions on some of the largest oil-producing countries (Iran and Venezuela) and constant price increases by OPEC. Additionally, supplies from Russia are the safest considering the vulnerability of maritime routes in the event of a conflict. Oil and gas pipelines via Russia are probably China’s most effective answer to its Malacca Dilemma. Moreover, burgeoning trade with Russia has allowed China to increasingly trade in the renminbi. Remarkably, the two countries have phased out trade in dollars almost completely. In 2023, over 90% of the settlements were made in either renminbi or ruble.

The fact that China has emerged as one of Russia’s biggest export destinations equips Beijing with leverage. Beijing can potentially resort to coercion through delays, pauses, payment disruptions, and re-negotiations with Moscow.

Russian Dependence on ‘High Priority Goods’

High-priority items refer to "50 dual-use products that are essential for manufacturing weaponry like missiles, drones, and tanks."

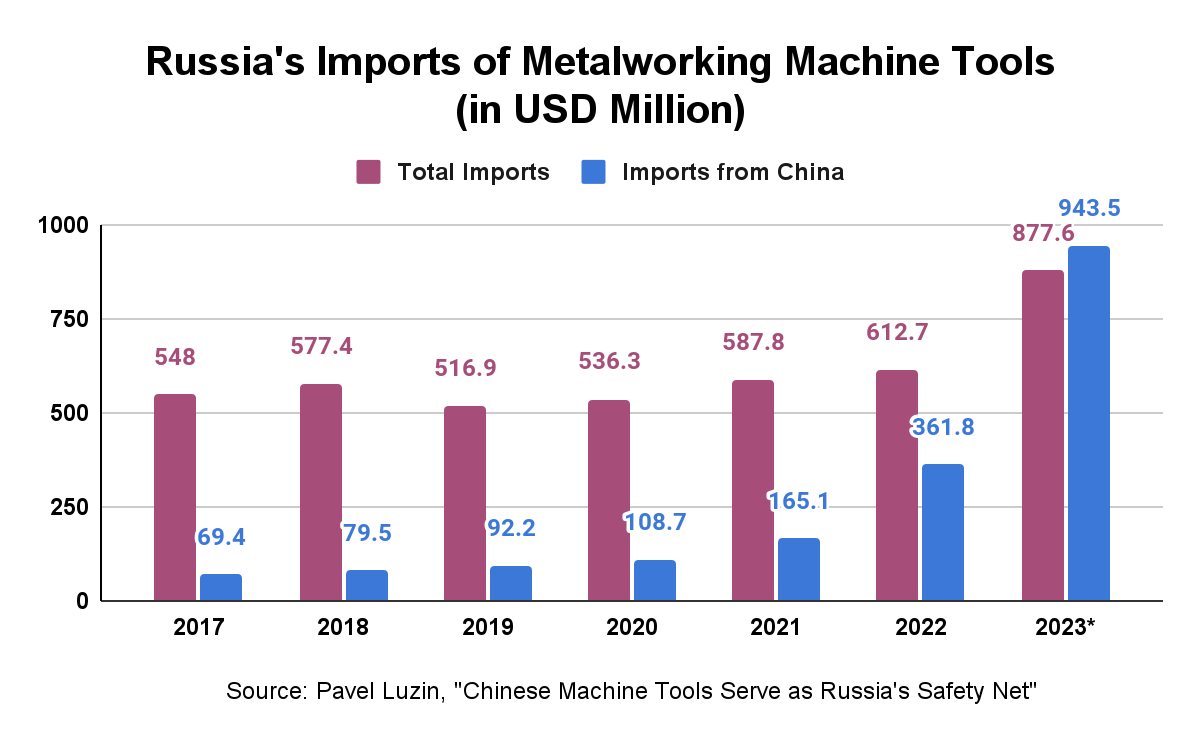

The war in Ukraine has significantly enhanced the importance of the metalworking industry critical to producing machine tools necessary for arms manufacturing

Russia’s domestic capabilities are fairly limited. Traditionally, relied on a range of suppliers to meet its demands.

As per 2022 trade data, Russia depended on imports for over 50 per cent of its requirement for metalworking machine tools. The drying up of supplies thus threatened to sabotage Russia’s combat and warfare capabilities against an adversary that was being heavily supported by the US-led West.

The latest trade data shows that China has stepped up to fill in for Russia’s demands. Compared to 2021, when high-priority goods from China accounted for 32 percent of Russia’s import needs, China’s share soared to 89 percent in 2023. Additionally, China’s share in Russian imports of critical machine tools has increased from 28 percent in 2021 to 59 percent in 2022. In 2023, almost all of Russia’s requirements were sourced from China.

Contrary to media reports, China has not been able to cut its Dependence on Russian arms

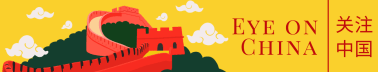

China has traditionally been one of the top importers of arms worldwide.

It has consistently figured in the world’s top five arms importers in the Stockholm International Peace Research Institute (SIPRI) database for over a decade except for in 2023 when it slipped to the tenth position.

China’s share as a percentage of global arms imports since 2011 hasn’t changed much (~4.5 percent) until 2023.

This means that China’s import of arms has been increasing over the years since the percentage has stayed stable while the global arms trade figures have risen.

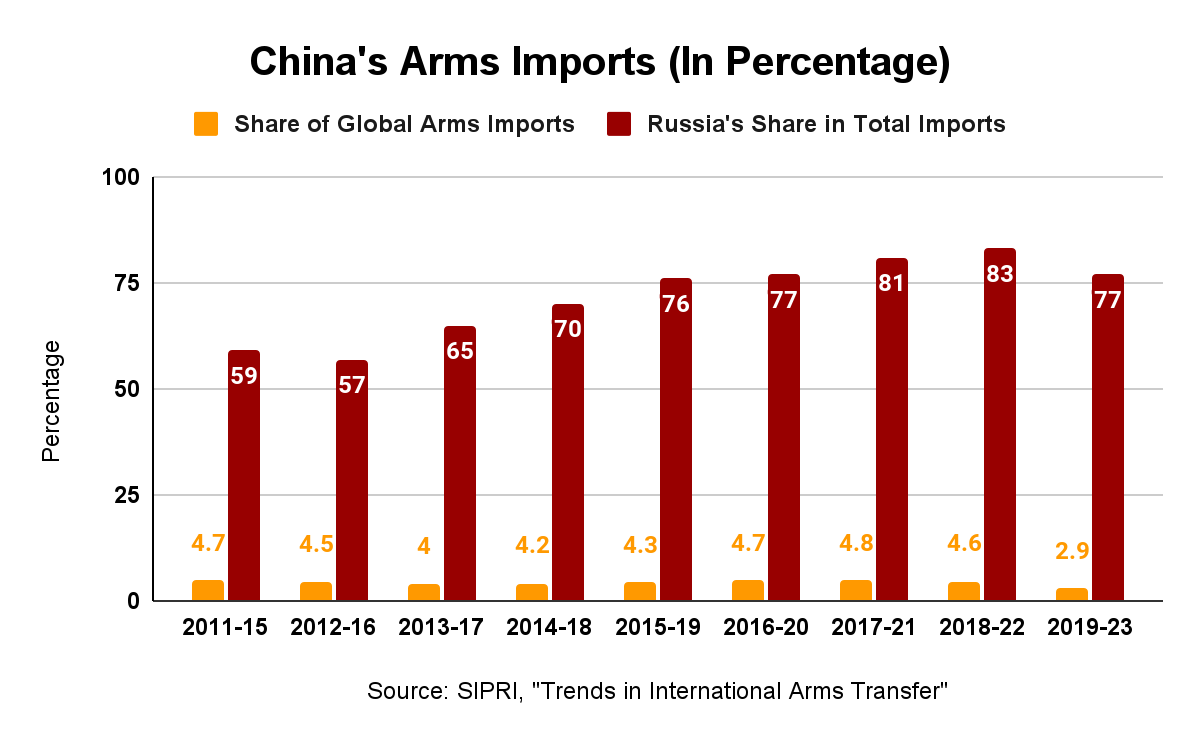

Russia has been the largest arms exporter to China.

Russia’s share in China’s arms imports has consistently increased until 2023

A decline in China’s share of its arms imports in 2023 cannot be attributed to its indigenisation efforts.

Instead, Russia’s failure to service the commitments in 2023 was responsible for the decline.

In this light, joint military exercises assume great significance. The two countries have stepped up their interactions in the past decade. Given that the primary objectives of such exercises are interoperability, adoption of best practices, knowledge sharing, and skill show, it is only reasonable that China seeks to learn from Russian experiences to strengthen its capabilities.

The Voice of the Masses

The Russia-China relationship has largely been driven by political elites. Putin and Xi have invested significant energy and effort in forging closer and deeper bilateral ties. A vacancy at any of the two leadership positions could slow down the momentum in bilateral ties.. In this light, it becomes imperative to assess popular perceptions in both countries to assess levels of trust and confidence. Effectively, such an assessment would serve as a metric to gauge the depth of the relationship beyond government-to-government-level bonhomie.

According to the latest 2023 survey conducted by the Levada Center, Russians view China and the Chinese (residents of China) quite favourably as compared to any other country.

In 2023, over 60 percent of the respondents thought of China as a great country, second only to Russia. Secondly, 85 percent of the respondents held a favourable view of China, while 83 percent held a favourable view of the Chinese (residents of China). Responding to questions on the opinion of the Chinese about the Russians, 81 percent believed that the Chinese viewed Russians favourably.

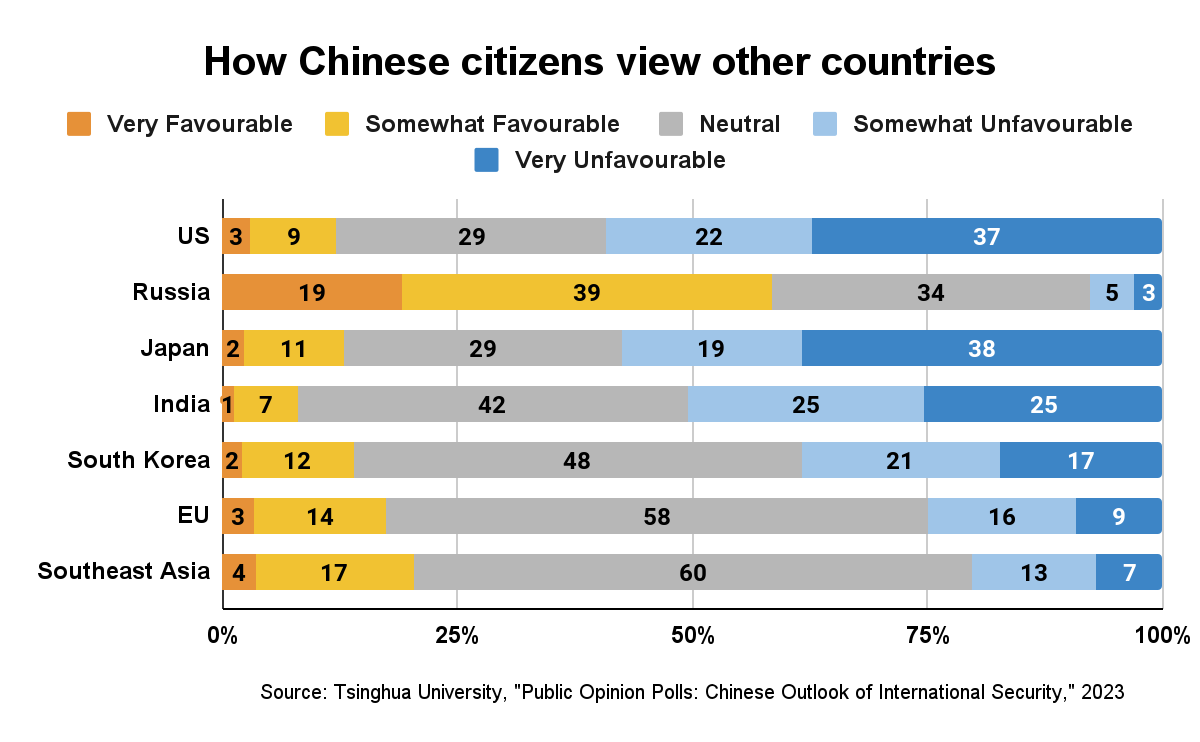

Russia too appears to be favourably viewed by the Chinese. A survey conducted by Tsinghua University in 2023 found that the Chinese regard Russia as the third-most influential country behind China and the US. Similarly, when asked about their impression of various countries, about 60 percent of the respondents held a favourable view of Russia. Lastly, more than 80% of respondents believe that the US and the Western countries are responsible for the war in Ukraine while less than nine percent blamed Russia for the crisis in Ukraine.

In China, several existing sub-narratives within the larger discourse underline the resolve of the Russian people and the great history of Russia. Discourse on social media indicates that Putin is “believed to be cunning, wise, and heroic, but also kind and well-meaning.” He is often referred to as “Pujing Dadi”, i.e. Putin the Great or Emperor Putin. Putin is “esteemed as a strongman (qiang ren) and people believe that Russia is invincible under Putin’s leadership. The propaganda around Putin is also used to justify and advocate strongman rule in China (support for Xi). This section of the Chinese netizens also believe that Russians are zhandou minzu or “fighting people, who do not know fear nor are they afraid to bring sacrifices in fighting the enemy.”

Some in China also believe that Russia is a strategic ally of China. Further, they believe that Beijing should stick with Moscow in order to prevail in the current geopolitical landscape. Even though they admit that Russia could pose a threat to China, they are convinced that the West is the primary enemy. Further, in response to a question that asked what could be the best course of action for China in response to the Russian invasion, 61 percent believed providing moral support to Russia is the best response while 16 percent thought “providing weapons to Russia” as the best possible response.

To Conclude…

A growing strategic alignment exists between China and Russia. This ever-increasing convergence is primarily a result of their mutual antipathy to the Western-dominated and US-led world order.

The China-Russia relationship, however, is not without its divergences such as varying time horizons for changing the global governance and financial architectures (Russia is more impatient about this than China), competition in Central Asia (China’s increasing economic influence in the region is challenging Russia’s position in its strategic backyard), policy over North Korea (the conclusion of Mutual Defence Cold-War style treaty between North Korea and Russia harms China’s strategic interests). Yet, these divergences are small when compared to the overarching strategic convergence between the two countries.

Overall, the China-Russia relationship has already entered a phase in its history where Russia heavily relies on China to realise its strategic objectives and economic rise. As the Russian economy has become increasingly isolated from the global economy (EU in particular), it has simultaneously witnessed deeper and deeper integration with the Chinese economy.